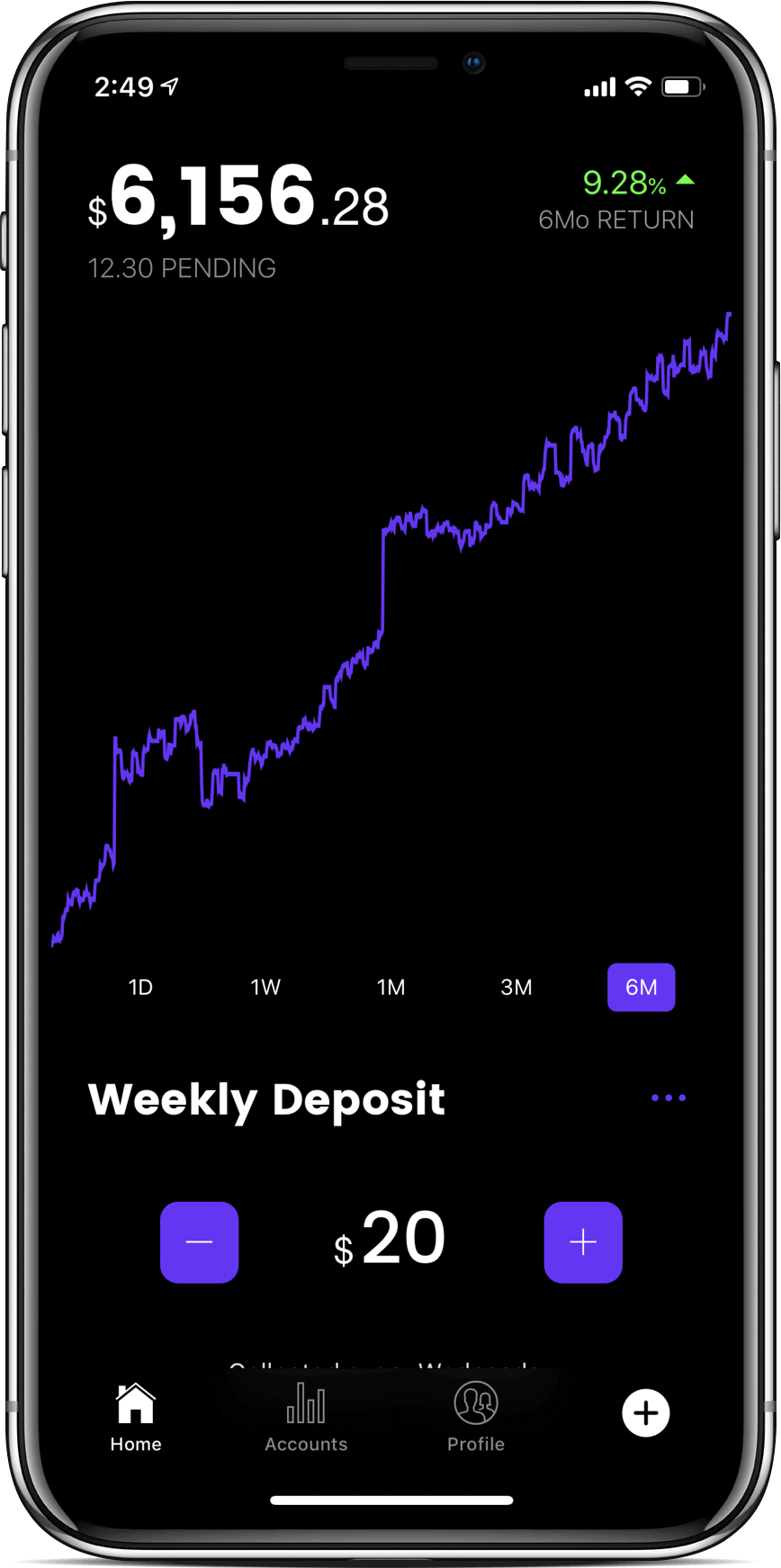

Set and forget

Our smart technology analyses your purchases and helps you automatically invest small amounts you can afford.

Grow your savings your way

FirstStep's expertly managed portfolios offer great growth potential for longer-term goals.

Choose from a range of investment options to personalise your portfolio.

Defensive

Lower risk, Lower return

Allocation:

Balanced

Medium risk, Medium return

Allocation:

Growth

High risk, Higher return

Allocation:

Your Core investment option invests in three ETFs (Australian Shares Index, International Shares Index, Australian Fixed Income) managed by Vanguard.

to your Core

Technology

Invest your money towards the brands you rely on everyday. Add the most innovative companies to your portfolio including Apple, Facebook, Amazon and Google.

Ethical

Invest where you know you are doing good (and as importantly, not doing harm). Add “Climate Leaders” from a broad range of global locations to your portfolio.

Health

Invest your money towards companies keeping us well. Add biotechnology, healthcare, medical equipment and pharmaceutical companies to your portfolio.

Asia

Invest towards large, established Asian companies listed in China, Hong Kong, Macau, Singapore, South Korea, and Taiwan.

Our smart technology ensures your portfolio is in balance.

What you're investing in

Your FirstStep portfolio is a diversified mix of exchange traded funds, ETFs for short. ETFs are made up of hundreds of stocks or bonds. We belive the right foundation for a risk-adjusted portfolio is to invest in ETFs, constructed by well-known investment management companies, that often replicate an index like the S&P/ASX 300 Index or the MSCI World Index.

Shares (or equities)

Investing in Shares is like owning parts of a company. Your FirstStep portfolio includes ETFs that holds hundreds of individual shares. If a company performs, their share price may go up, leading to better potential returns for you.

Bonds (or fixed income)

Bonds are a debt investment where an investor loans money to a business or government and gets paid back with interest. Bonds are generally less risky than shares and help diversify your portfolio.